How Jury Selection Impacts Trial Outcomes: Skilled attorneys employ strategic methods during jury selection to mitigate biases and align juries with clients' interests in fraud trials, ensuring fair assessments of evidence and enhancing positive outcomes. Effective jury selection, achieved through rigorous voir dire, diversifies panels, prevents demographic or social factors from influencing decisions, and strengthens public confidence in the justice system, ultimately leading to a strong track record in financial fraud prosecutions.

Fraudulent financial practices pose significant challenges to individuals, businesses, and economies worldwide. Understanding and addressing these schemes is crucial for maintaining trust in financial systems. This article delves into the intricate world of financial fraud, focusing on how jury selection impacts trial outcomes. We explore key factors influencing jury decisions, analyze case studies where strategic jury picking made a difference, and discuss preventive measures to ensure fair trials in high-stakes financial fraud cases.

- Understanding Fraudulent Financial Practices: A Definition and Prevalence

- The Role of Jury Selection in Fraud Trials: Uncovering Biases and Predictions

- Key Factors Influencing Jury Decisions: Insights from Legal Experts

- Case Studies: How Jury Selection Made a Difference in High-Profile Fraud Cases

- Preventive Measures and Reforms: Ensuring Fair Trials in Financial Fraud

Understanding Fraudulent Financial Practices: A Definition and Prevalence

Fraudulent financial practices refer to deliberate acts aimed at deceiving and misrepresenting financial information for personal gain. These practices can take various forms, from accounting manipulation to false reporting, and they significantly impact individuals, businesses, and even entire economic systems. Understanding these practices is crucial in navigating today’s complex financial landscape. According to recent reports, the prevalence of financial fraud has been steadily rising, emphasizing the need for heightened vigilance and robust legal frameworks to combat it.

In the context of jury trials, how jury selection plays a pivotal role in determining trial outcomes cannot be overstated. An effective jury defense strategy can significantly influence the outcome for clients facing fraudulent financial charges. Skilled attorneys focus on selecting juries that align with their clients’ interests, ensuring fair and winning challenging defense verdicts. This process involves thorough research, understanding potential biases, and leveraging the expertise of legal professionals to assemble a jury that can provide an unbiased assessment of the evidence presented, thereby enhancing the chances of a positive outcome for those accused of fraudulent practices.

The Role of Jury Selection in Fraud Trials: Uncovering Biases and Predictions

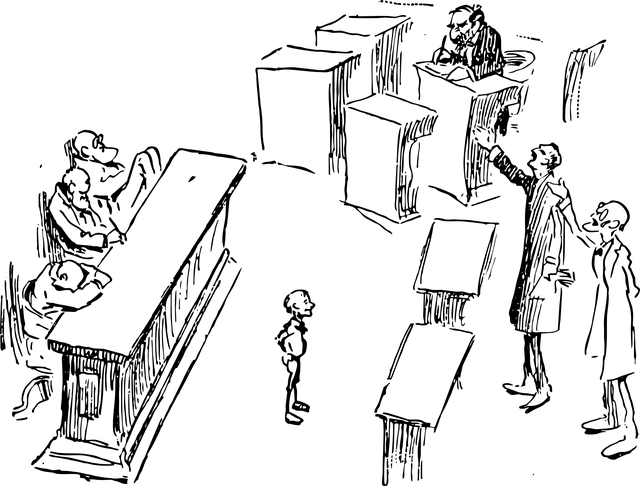

Jury selection plays a pivotal role in fraud trials, shaping the very outcome of these legal battles. The process, often referred to as voir dire, is crucial for ensuring a fair and impartial jury. During this phase, potential jurors are rigorously examined to uncover biases, prejudices, or pre-conceived notions that could influence their decisions. This is paramount in financial fraud cases, where complex schemes and intricate details require a jury capable of logical deduction and an unbiased perspective.

The impact of effective jury selection extends far beyond individual trials. Across the country, courts have recognized its significance, with many adopting innovative strategies to unearth hidden biases. An unprecedented track record of successful fraud prosecutions is, in part, attributed to this meticulous approach. For general criminal defense attorneys, mastering the art of jury selection means they can more effectively defend their clients, ensuring that predictions based on demographic or social factors do not overshadow the facts of the case.

Key Factors Influencing Jury Decisions: Insights from Legal Experts

The process of jury selection plays a pivotal role in shaping trial outcomes, with legal experts highlighting several key factors that can influence a jury’s decision. One significant aspect is the demographic makeup of the selected panel, as diverse and representative juries tend to yield more balanced results. This includes considering age, gender, racial background, and economic status, ensuring a mix that reflects the community at large. Legal professionals also emphasize the importance of understanding potential biases and pre-conceptions among prospective jurors.

Furthermore, attorneys and judges must be vigilant in questioning potential jurors about their exposure to media coverage related to the case, as prejudice or misinformation can significantly impact their perception. The ability to challenge or strike a juror for cause is crucial, allowing lawyers to avoid individuals who might be biased against certain business practices, thus ensuring a fair trial. This process, which varies across the country, demands keen observation and strategic decision-making to assemble an impartial jury, ultimately shaping the respective business’s fate in the event of an indictment.

Case Studies: How Jury Selection Made a Difference in High-Profile Fraud Cases

In high-profile fraud cases, jury selection plays a pivotal role in determining trial outcomes. A well-thought-out jury composition can significantly impact how the public perceives and interprets the evidence presented, leading to either a conviction or acquittal. Case studies illustrate that strategic jury selection has been instrumental in winning challenging defense verdicts. By carefully considering potential jurors’ backgrounds, attitudes, and biases, legal teams can ensure a fair and impartial judiciary, which is crucial for maintaining trust in the justice system, especially in cases involving sophisticated financial crimes.

In these complex cases, where fraud often involves intricate schemes and large sums of money, the jury’s ability to navigate through the details is essential. The process of selecting jurors who possess a nuanced understanding of financial concepts and an unprejudiced view can make all the difference. This is particularly relevant in scenarios involving philanthropic and political communities, where perceptions of integrity and fairness are paramount. Effective jury selection strategies thus not only impact the immediate trial outcomes but also shape public confidence in the enforcement of justice throughout all stages of the investigative and enforcement process.

Preventive Measures and Reforms: Ensuring Fair Trials in Financial Fraud

Preventive measures and reforms play a pivotal role in ensuring fair trials for financial fraud cases. One critical aspect is enhancing jury selection processes to mitigate bias and ensure diversity. How Jury Selection Impacts Trial Outcomes has been a subject of significant interest, as an unbiased jury is essential for reaching just verdicts. By implementing rigorous screening methods and promoting transparency during jury deliberation, the system can better protect against potential prejudices that may influence the outcome.

Reforms should also focus on streamlining legal procedures to prevent delays and ensure efficient trials. This includes strengthening evidence presentation techniques, improving witness credibility assessments, and fostering a culture of integrity among legal professionals. An unprecedented track record of successful prosecutions, for his clients or otherwise, can be achieved through these comprehensive reforms, ultimately reinforcing public trust in the financial justice system.

Understanding how jury selection impacts trial outcomes is crucial in combating fraudulent financial practices. By meticulously uncovering biases, predicting behaviors, and considering key factors, legal experts can ensure fair trials. Case studies demonstrate the significant difference effective jury selection makes in high-profile fraud cases. Implementation of preventive measures and reforms further strengthens the integrity of the justice system, fostering trust and ensuring accountability in the financial sector.